Where & How to Use Apple Pay

It’s at More Places Than You Might Expect

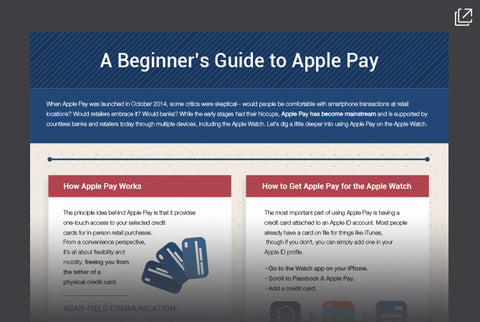

When Apple Pay was launched in October 2014, some critics were skeptical -- would people be comfortable with smartphone transactions at retail locations? Would retailers embrace it? Would banks? While the early stages had their hiccups, Apple Pay has become mainstream and is supported by countless banks and retailers today through multiple devices, including the Apple Watch. Let's dig a little deeper into using Apple Pay on the Apple Watch.

How Apple Pay Works

The principle idea behind Apple Pay is that it provides one-touch access to your selected credit cards for in-person retail purchases. From a convenience perspective, it’s all about flexibility and mobility, freeing you from the tether of a physical credit card -- because while many people sometimes forget a credit card, a phone has become a much more essential piece of day-to-day life. However, when you go under the hood of the Apple Pay process, you get a better sense of why it works so well.

Near-Field Communication: To connect Apple Pay with a payment terminal, a special chip known as an NFC (Near-Field Communication) chip is built into your Apple device. This allows for transactions when your device is within an inch of a terminal. When it is in this proximity, the two devices enable a secure transmission of data.

Apple ID: Contrary to popular belief, using Apple Pay does not store credit card information on your iPhone or Apple Watch. Instead, your credit card info is saved in your Apple ID. When you use Apple Pay, encrypted data is sent with tracking identification based on your Apple ID, which can only be decrypted by the bank. In layman’s terms, the actual credit card is never part of the transaction process; it’s protected behind several layers of encryption and devices.

Confirmation: While Apple Pay works within a select group of mobile apps, its true beauty comes from giving you freedom and security on an in-person retail level. This is finalized on iPhones by the use of Touch ID, AKA Apple’s fingerprint identification system. When an Apple Pay transaction executes, it isn’t processed until confirmed via Touch ID acceptance. For Apple Watches, the account data is stored separately from iPhones, so a passcode is needed when the watch is removed/placed on a wrist (though able to be used freely until removed again).

How to Get Apple Pay for the Apple Watch

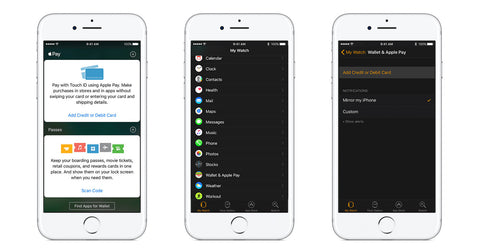

The most important part of using Apple Pay is having a credit card attached to an Apple ID account. Most people already have a card on file for things like iTunes, though if you don't, you can simply add one in your Apple ID profile.

After that, there are a number of ways to get Apple Pay, including a standalone Apple Watch experience. To get Apple Pay on your Apple Watch, go to the Watch app on your iPhone and scroll to Passbook & Apple Pay. This is where you'll add a card. Note that for the iPhone, you won't have to add a card if there's an existing card on file. However, with the Apple Watch, it's required to add a card due to the Watch's standalone secure element. You will most likely have to go through a verification process for your card through the bank.

Once it's set up, you can easily access Apple Pay to make retail purchases via your Apple Watch. Note that while the iPhone is proximity based without unlocking, the Apple Watch requires a few short steps.

First, double-press the Apple Watch’s side button for quick access to payment selection (you can also navigate through the watchOS menu). Then, select the card you want to use by leaving it on the default or swiping left/right. Finally, hold your Apple Watch within an inch of the reader terminal until you feel a slight tap or vibration.

To prevent fraud on an Apple Watch, Apple requires entry of the Watch’s passcode when it senses that it’s been placed on the wrist or locked from a manual lock. This level of protection ensures that no one can just steal the Apple Watch and use Apple Pay freely when wearing it throughout your day.

Because the Apple Watch access your Apple Pay information separately from your iPhone, that means that you don’t have to have your iPhone with you to use it. Not only is this helpful on those pesky days when you forget your iPhone at home, but also for workout junkies that like to run or cycle with only their Apple Watch -- with Apple Pay, it’s easy to still stop into a retailer and buy a snack or beverage despite not having your wallet or iPhone with you.

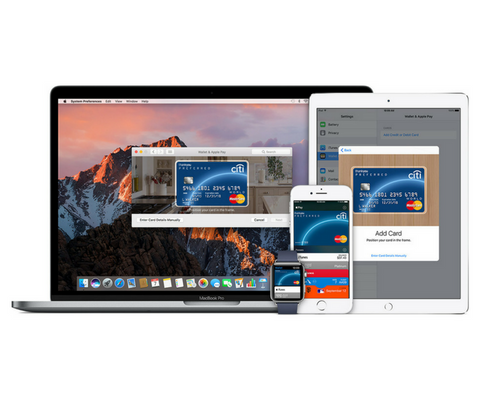

Speaking of which, what about the iPhone? Of course, the Apple Watch works similarly through Apple’s flagship device, with the main difference being Touch ID confirmation for each transaction. Apple Pay is supported on iPhones from iPhone 6 and up, though if you still use an older iPhone 5 model, you can still use Apple Pay if you have an Apple Watch.

Who Supports Apple Pay?

As of May 2017, hundreds of American banks support Apple Pay, meaning that any credit or debit card issued by those banks can be associated with an Apple Pay/Apple ID account. These include major national banks such as American Express, Bank of America, US Bank, Wells Fargo, and more -- check the official list at Apple’s website.

Apple Pay is also accepted at many nationwide retailers, though for people exercising strictly wearing their Apple Watch and no iPhone, they may be happy to see that places such as Whole Foods, Starbucks, Peets, and even McDonald’s (you’ve earned that Big Mac after a long run, right?) allow you to use Apple Pay.

![]()

Simply look for credit card terminals that have the Apple Pay icon (there are more of them than you might think) and you’re ready to go. And though you may come across old information about a $25 cap on spending, that has been lifted, though you may still need to provide signature for purchases over $50.

Internationally, Apple Pay works just the same, which means that it’s a convenient payment method for world travelers. Some payment limits remain, though those usually mean that either a signature or some other form of confirmation is required. See Apple’s international list for more information.

Benefits of Apple Pay

For many people, the instinctive response to a smartphone-based payment system is skepticism. After all, the news is rife with stories about digital fraud -- hacking into accounts, stealing phones and identities, etc. Why would using an iPhone to buy things in person be safer than, say, simply using a credit card or cash?

While cash is certainly the safest way to avoid account fraud, it’s not exactly convenient to always have on hand -- plus there’s the whole old-school robbery thing to worry about. Credit cards may seem safer to use, but there are many ways credit card numbers can be acquired, from card skimmers to plain old human eyes. Even with chip cards, which have certainly helped reduce fraud, there are still ways for credit card numbers to get used for unscrupulous purposes.

On the other hand, despite many people’s first impressions of iPhone-enabled paying, Apple Pay is actually considered safer for a few different reasons:

Fewer Eyeballs: Because of the unique way Apple’s system delegates how account information is stored and moved around -- essentially making the Apple ID a proxy for your credit card -- it actually never passes bank information at a store. Thus, anyone using card skimmers or unscrupulous employees have no way of lifting that information.

Biometrics: To confirm your purchase with Apple Pay, you have to tap the Touch ID area of your phone. That means that your personal fingerprint is responsible for completing the transaction -- something that’s very hard to replicate, even if someone stole your iPhone. And if someone does steal your phone, it’s possible to lock them out of the device from your Apple ID recovery options.

Freedom from Physical Cards: Physical credit cards can be easily lost or stolen; in fact, there were reports of people leaving them in chip readers when chip-based credit cards were first implemented. Purchasing with a stolen credit card -- particularly online -- is extremely easy to do, and since Apple Pay allows you to go out of the house without carrying a physical card, you’re already eliminating that path to fraud.

Of course, if you're using Apple Pay on your Apple Watch, you'll want to make sure it rests comfortably on your wrist. That's why you'll want to have top-of-the-line Apple Watch bands from Monowear. Whether you're looking for classic style or a quality workout band, Monowear has something for every Apple Watch user.